Introduction

Koperasi JayaDiri Malaysia Berhad (KOJADI) is established in 1981as a cooperation regulated by The Co-operative Societies Act 1993, with an objective to offer educational loan facility to needy students for higher education and nurture human resource into well-trained manpower for the Nation.

KOJADI has a membership of over 62,000 with total assets of over RM156 million. KOJADI has since granted over RM238 million in study loans to more than 10,000 students for their studies locally and abroad.

Financial Assistance from KOJADI

RM5000.

RM5,000 Loan Allocation

| Description | Amount |

|---|---|

| SA Joining Fee + 6% GST | RM614.80 |

| HuaweiPhone (Android Device) | RM500 |

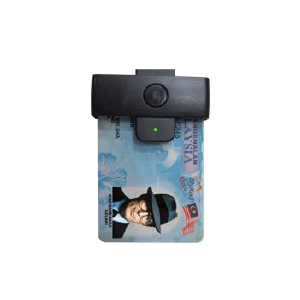

| 1 unit mReg(Huawei X1 + MyKadReader) | RM1050 |

Others ChargesBy KOJADI

|

RM277 |

| redONE E-Wallet | RM2500 |

| Total | RM5,041.80 |

Sales Advisor Starter Kit

|

|

|

|

|

|

|

|

Loan Details

| Loan Description | 3 Years | 4 Years | 5 Years |

|---|---|---|---|

| Loan amount | RM5,000 | RM5,000 | RM5,000 |

| Interest rate 4% per annum | RM200 per annum | RM200 per annum | RM200 per annum |

| Total loan interest | RM600 | RM800 | RM1,000 |

| Loan period | 3 years(36 months) | 4 years(48 months) | 5 years(60 months) |

| Repayment per month | RM155.60 per month | RM120.83 per month | RM100 per month |

*Duration of loan based on KOJADI approval

Frequently Asked Questions

1. Who can apply?

Malaysian citizen between 21 to 40 years old. The applicant is required to be a member of KOJADI with RM100 initial shares and RM10.60 membership fee (including 6% GST).

2. What is the purpose of micro credit?

- For expansion of business.

- As start up cost of new business venture.

- Other purpose subject to approval of the Board from time to time (with supporting documents).

3. What is the tenure of micro credit?

From 3 years to maximum 5 years.

4. What is the loan ceiling?

RM5,000.

5. What is the rate of interest chargeable in respect of the loan?

4.0% flat interest rate per annum with fixed monthly instalments.

- Applicant / borrower bear 4% interest.

- RM100 to cover repayment if more than 15 lines a month.

6. What is the amount of processing fee?

| No | Description | Amount |

|---|---|---|

| 1 | Processing fee & administration fee – RM200 + 6% GST (based on RM5000) | RM212 |

| 2 | Stamp duty fees –Facilities Agreement (RM25) & Guarantee Agreement (RM10) | RM35 |

| 3 | PA Insurance for5 years (Below rm30) | RM30 |

| Total | RM277 | |

*All fees will be deducted from the approved loan amount.

7. How does a borrower make monthly repayment?

Payment can be made monthly at KOJADI office or to pay into a KOJADI designated account with a specific bank.

- Public Bank – Cheque Deposit Machine (CDM) or Cash Deposit Terminal (CDT) or Online Transfer

- CIMB Bank – Cash Deposit Terminal (CDT)

- Maybank – Cash Deposit Terminal (CDT) or Online Transfer

8. Must the borrower provide a guarantor and what is the qualification of the guarantor?

- Yes. The guarantor is preferable to be immediate or next of kin of the family members of the applicant.

- Guarantor must be a Malaysian citizen between 21 to 55 years old.

- RM20,000 or below – 1 guarantor with monthly income not less than RM3,500 or 2 guarantors with monthly income not less than RM2,000 each.

9. Can joint business owners apply?

Application may come from joint business owners or individuals who are member of KOJADI. (However no corporation be it a limited company or firm may apply as only individual members of KOJADI are eligible)

10. Can MCA members or single parents involved in business apply?

Yes! Extra merits will be given to MCA Members / NGO Leaders / Single Parents during credit evaluation on their application.

11. What are the application procedures?

- Complete Micro Credit Application Form and KOJADI Membership Application Form and submit it together with the RM110 initial shares and membership fees

- Submit 1 certified copy of identification card of the applicant and guarantor(s)

- Submit 1 passport-size photograph of the applicant and guarantor(s)

- Submit a recent copy of the applicant’s home & office telephone, electricity & water bills

- A copy of the applicant’s business registration certificate

- Business Proposal / Management Account / P&L Statement

- Applicant‘s latest six months company bank statement

- Submit a certified copy of Applicant’s and Guarantor’s proof of income (latest Income Tax borang B/BE or EA Form or EPF Statement)

- Application form preferably with endorsement by any MCA Division / Branch / Other relevant Chinese Youth Organizations

- redONE SA Application Form, E-Wallet, mReg and PDPA application form

12. Where and how to obtain the micro credit and KOJADI membership application form?

Application form for both Micro Credit and KOJADI membership can be downloaded from the MCA or KOJADI Official Website at www.mca.org.my or www.kojadi.my or get from redONE Channel Manager.

13. Where should the application be submitted?

redONE Channel Manager.

14. Can a borrower apply for a second loan once he/she has paid off the loan?

Yes.

** Please enclose the payment of RM100 for membership initial shares and RM10.60 entrance fee* when submitting your application (*includes 6% GST).

** In the event that the loan application is rejected, membership fee is refundable.

Loan Repayment Flow